2024 Iceland Snus Policy: A Comprehensive Overview

Introduction

As the world continues to evolve its stance on tobacco and nicotine products, Iceland is no exception. The country has implemented significant regulatory measures concerning snus (oral tobacco). This blog will delve into Iceland's 2024 snus policy, providing an in-depth analysis of market data, a competitive landscape, and strategic insights for starting a snus business in Iceland.

Overview of Iceland's 2024 Snus Policy

In 2024, Iceland has tightened its regulations on snus, focusing on public health concerns and the prevention of youth access to tobacco products. The policy includes stringent labeling requirements, restrictions on marketing and advertising, and specific sales regulations. These measures aim to reduce the consumption of snus among young people and mitigate the health risks associated with tobacco use.

Key Policy Highlights

Labeling and Packaging: Snus products must carry prominent health warnings covering at least 65% of the packaging. The warnings must be clear and graphic to ensure consumers are fully aware of the health risks.

Advertising Restrictions: All forms of advertising and promotion of snus are banned. This includes online marketing, sponsorships, and point-of-sale advertising.

Sales Restrictions: Snus can only be sold in licensed tobacco shops, and age verification is mandatory for all purchases. Sales through vending machines and online platforms without stringent age verification are prohibited.

Product Composition: The policy mandates the disclosure of ingredients and restricts the levels of certain harmful substances in snus products to minimize health risks.

Market Analysis

Consumption Trends

Despite regulatory restrictions, snus remains popular in Iceland, particularly among adults looking for alternatives to smoking. According to recent data, approximately 12% of the adult population uses snus regularly. This trend is driven by the perception of snus as a less harmful alternative to smoking and its convenience as a discreet form of nicotine consumption.

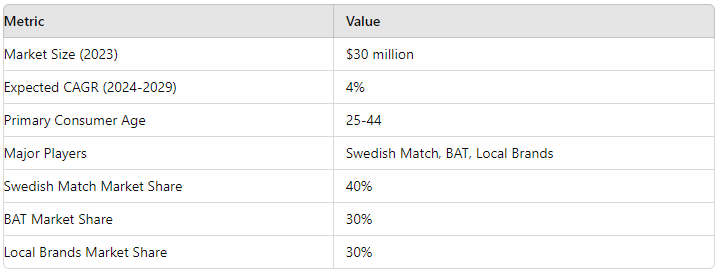

Market Size and Growth

The Icelandic snus market was valued at approximately $30 million in 2023 and is expected to grow at a CAGR of 4% over the next five years. This growth is attributed to increasing consumer awareness of the risks of smoking and the availability of diverse snus products catering to different preferences.

Consumer Demographics

The primary consumers of snus in Iceland are adults aged 25-44, predominantly male. However, there is a growing interest among younger adults aged 18-24, highlighting the importance of stringent youth prevention measures.

Competitive Landscape

Key Players

The Icelandic snus market is dominated by a few key players, including international brands and local manufacturers. The major players include:

Swedish Match: A leading producer known for its high-quality snus products.

BAT (British American Tobacco): Offers a wide range of snus flavors and strengths.

Local Icelandic Brands: Smaller companies producing traditional and innovative snus products.

Market Share

Swedish Match: 40%

BAT: 30%

Local Brands: 30%

Strengths and Weaknesses

Swedish Match: Strong brand recognition, extensive distribution network, but high prices.

BAT: Competitive pricing, wide variety, but less local market presence.

Local Brands: Cultural relevance, traditional flavors, but limited distribution.

How to Start a Snus Business in Iceland

Step-by-Step Guide

Market Research: Conduct thorough research on consumer preferences, market trends, and regulatory requirements.

Business Plan: Develop a comprehensive business plan outlining your strategy, target market, financial projections, and compliance measures.

Licensing and Permits: Obtain the necessary licenses and permits to sell tobacco products in Iceland.

Product Development: Source high-quality ingredients and develop a range of snus products that comply with Icelandic regulations.

Distribution Network: Establish a distribution network, focusing on licensed tobacco shops and potential partnerships with local retailers.

Marketing Strategy: Develop a marketing strategy within the constraints of advertising restrictions, leveraging point-of-sale promotions and word-of-mouth marketing.

Compliance: Ensure ongoing compliance with all regulatory requirements, including packaging, labeling, and sales restrictions.

Potential Challenges

Regulatory Compliance: Adhering to strict regulations can be challenging and requires continuous monitoring.

Market Competition: Competing with established brands necessitates a unique value proposition and strong market differentiation.

Consumer Awareness: Educating consumers about your brand and product benefits without traditional advertising can be difficult.

Conclusion

Navigating the 2024 snus policy in Iceland requires a strategic approach, thorough market understanding, and unwavering commitment to compliance. By leveraging market insights, addressing consumer needs, and maintaining a strong focus on quality and safety, you can successfully establish and grow a snus business in Iceland. Stay informed about policy changes, continuously innovate, and build strong relationships with consumers to thrive in this regulated market.

Data Analysis

Understanding and adapting to the evolving regulatory landscape is crucial for success in the Icelandic snus market. With the right strategy, businesses can navigate these challenges and capitalize on the growing demand for snus products in Iceland.

Runfree Upgraded Big Puffs 25000 RGB LED Light Disposable Vape

Runfree Upgraded Big Puffs 25000 RGB LED Light Disposable Vape Hot Sale Runfree BC5000 Puffs Rechargeable Disposable Vape

Hot Sale Runfree BC5000 Puffs Rechargeable Disposable Vape Lung Smoking 15000 Puffs Disposable Vape With Display Screen

Lung Smoking 15000 Puffs Disposable Vape With Display Screen Adjustable power Dual Mesh Coil 8000 Puffs Disposable Vape

Adjustable power Dual Mesh Coil 8000 Puffs Disposable Vape Wholesale Big Puffs 30000 Dual Mesh Coil Disposable Vape Box

Wholesale Big Puffs 30000 Dual Mesh Coil Disposable Vape Box 2024 Hot sale Trend Flash light 15000 Puffs Disposable Vape

2024 Hot sale Trend Flash light 15000 Puffs Disposable Vape RF003 600 Puff 2ml Oil Disposable Vape With TPD CE

RF003 600 Puff 2ml Oil Disposable Vape With TPD CE RF015 600 Puff Replaceable Rechargeable Light Disposable Vape With TPD

RF015 600 Puff Replaceable Rechargeable Light Disposable Vape With TPD Runfree RF008 8000 Big Puffs Trendy and cool Disposable Vape

Runfree RF008 8000 Big Puffs Trendy and cool Disposable Vape Runfree 2024 New Big Puffs 15000 Replaceable Disposable Vape

Runfree 2024 New Big Puffs 15000 Replaceable Disposable Vape Hot Sale 1ML Refillable Ceramic Core Disposable CBD Device

Hot Sale 1ML Refillable Ceramic Core Disposable CBD Device